Hail damage is a common occurrence in Australia, particularly during the summer months. While most homes and businesses are covered by insurance for this type of damage, there are some things you need to know in order to make sure you are properly protected.

While hail damage is usually covered by insurance policies, it’s important to check your policy details to be sure. Some policies may have exclusions or limitations on the amount of cover for hail damage. Join Vertec as we go over how to claim hail damage on roof insurance, as well as important information you need to know before going to your insurer.

Roofing insurance can cover a number of different types of damage in Australia. The most common type of damage that is covered by roofing insurance is storm damage.

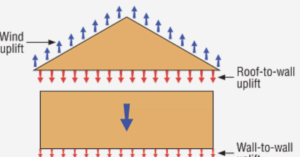

Damage covered by roofing insurance can include damage from high winds, hail, or heavy rain. Roofing insurance can also cover damage from fire, theft, or vandalism.

If you have a problem with your roof, it is important to contact your insurer as soon as possible to see if they will cover the cost of repairs. Like any home or property insurance, it is important to refer to your individual policy to understand what you are (and are not) covered for.

As anyone living on the eastern seaboard of Australia can tell you, hail can cause serious damage to roofs, and if not caught early, can lead to expensive repairs. Here are four signs of hail damage to look for on your roof:

After a severe storm, take a close look at your shingles. If you see any that are missing or damaged, this is a sure sign of hail damage. In some cases, the damage may be minor, and the shingles can be replaced. However, in more severe cases, the hail damage may be extensive enough that the entire roof needs to be replaced.

Another sign of hail damage to look for is cracked or split shingles. These can be caused by large hail stones hitting the roof with enough force to crack the shingles. In some cases, the damage may only be cosmetic, but in more severe cases, the structural integrity of the roof could be compromised.

If your roof is made of metal, hail can cause dents to form in the roofing material. This type of damage is usually only cosmetic, but if the dents are severe enough, they could affect the performance of the roof.

After a storm, take a look at your gutters and downspouts. If you see a significant amount of granules (the small, pebble-like pieces that make up shingles), this is another sign of hail damage. The granules help protect the shingles from UV rays and wear, so if there are a lot of them in your gutters, it’s likely that the hail has caused significant damage to your roof.

Hail damage can worsen over time, so the sooner it’s repaired, the better. Contact a local roofing contractor as soon as you notice any signs of hail damage.

Wondering how to claim hail damage on your roof? If you think your roof has sustained hail damage, the first step is to call your insurance company and open a claim. Once your claim is open, an adjuster will be assigned to your case and will schedule a time to inspect the damage.

The adjuster will assess the damage and determine if it meets your insurance policy’s criteria for a covered claim. If so, you will be reimbursed for the cost of repair or replacement, minus any applicable deductible.

The best time to make an insurance claim on your hail damaged roof is yesterday, the second-best time is today!

It’s important to note that most insurance policies require you to act within a certain timeframe from when the damage is incurred, so be sure to act quickly if you think your roof has been damaged by hail.

If hail has caused significant damage to your roof, it may need to be replaced, which can be costly. In addition, if you have an insurance report from a previous inspection, your insurance company may require you to get the roof repaired or replaced before they will insure your home.

Finally, if you live in an area where hailstorms are common, your home insurance rates may be higher than average.

There are a few things that you can do to minimise the impact of hail damage on your property value and future claims. First, if your roof is more than 10 years old, it is a good idea to have it inspected by a certified roofing contractor.

They will be able to assess the severity of the damage and determine if repair or replacement is necessary.

Second, if you have a Hail Damaged Roof Certificate, make sure to keep it in a safe place and provide it to your insurance company when filing a claim. This will help them process your claim more quickly.

Finally, if you live in an area where hailstorms are common, consider purchasing home insurance that includes hail coverage. This will help protect your property value in the event of a severe hailstorm.

Let’s face it – insurance companies don’t have the best reputation.

Unfortunately, some insurers are quick to deny hail damage claims, even when the damage is severe.

There are a few reasons why an insurer might deny a hail damage claim. One is that the insurer may not believe that the damage is severe enough to warrant repairs. Another reason is that the insurer may think that the damage was caused by something other than hail (such as wear and tear).

If your insurance provider is denying your claim, it is worth getting in contact with a roofing professional (like Vertec) who can talk you through the process and alert you of your options.

Again, this will come down to the individual home insurance policy that you have elected.

In most cases, homeowner’s insurance policies will cover tree damage caused by a covered threat, such as a severe storm. However, there are some circumstances where coverage may be limited or excluded altogether. For example, if the tree was already dead or dying before the storm, the insurance company may not cover the damage.

It’s always a good idea to review your policy documents carefully to make sure you understand what is and is not covered.

Vertec Roofing is a leading provider of roofing repairs following hailstorms. We have the experience and expertise to repair any damage quickly and efficiently to your roof, ensuring that your home or business is protected from further weather damage.

We understand the importance of getting your roof repaired as soon as possible after a storm, and we will work with you to ensure that the repairs are completed as quickly and efficiently as possible. Contact us today to learn more about our hailstorm repair services that specialise in dealing with leaking roofs.

Please Note: This article is only a guide, any advice within this article is general advice only and has been organised without consideration of your individual insurance policy and its coverage. It is important to check with your insurance provider exactly what is covered.

At Vertec Roofing, we believe roofing is about protecting homes and enhancing comfort.